Market fluctuations are an inherent aspect of investing, and 2025 has certainly demonstrated this reality. Although downturns in the market—like those triggered by tariff concerns—can feel uncomfortable, they often present chances to purchase assets at better prices. Conversely, when markets rebound and hit record peaks, some investors may experience anxiety despite solid fundamentals. In either situation, maintaining portfolios designed to endure all market cycle phases while keeping long-term financial objectives in focus becomes increasingly critical.

Entering the year's final quarter, investors confront contradictory indicators. During the third quarter, the S&P 500 achieved fresh record highs, buoyed by robust corporate profits and artificial intelligence optimism. Simultaneously, significant labor market deterioration since early summer has sparked worries about economic fundamentals and consumer financial stability. Nevertheless, GDP expansion has remained robust, and inflation has generally been contained.

Such market conditions highlight the value of long-term investment strategies and financial planning. Instead of responding to news cycles and economic data releases, maintaining well-structured portfolios capable of adapting to market changes proves more valuable. This necessitates comprehending the fundamental trends that will influence markets in upcoming quarters.

Third Quarter Market and Economic Highlights

· Throughout the third quarter, the S&P 500, Nasdaq, and Dow Jones Industrial Average posted gains of 7.8%, 11.2%, and 5.2% respectively, with each index setting new records in September. For the year through September, these indices have advanced 13.7%, 17.3%, and 9.1%.

· The Bloomberg U.S. Aggregate Bond Index delivered a 2.0% return in the third quarter, bringing year-to-date performance to 6.1%. The 10-year Treasury yield concluded the quarter at 4.15%, having touched a low of 4.02% in September.

· International developed market equities (MSCI EAFE) appreciated 4.2% while emerging market equities (MSCI EM) gained 10.1% during the quarter.

· Gold climbed to an unprecedented $3,841 per ounce, marking a 16% quarterly increase.

· Bitcoin finished at $114,641, posting a quarterly gain while remaining beneath its August high.

· The U.S. Dollar Index dropped to 96.63 in September before closing the quarter at 97.78. Year-to-date, the dollar has weakened 9.9%.

· August's Consumer Price Index showed a 2.9% increase, with core CPI advancing 3.1%.

· According to the Bureau of Labor Statistics' latest report, August saw just 22,000 net new jobs added. From May onward, monthly job creation has averaged merely 26,800.

· During its September meeting, the Federal Reserve reduced rates by 0.25% to a 4% to 4.25% range.

Market valuations approach historically elevated territory

For long-term investors, understanding overall market valuation levels represents a crucial consideration. Beyond simply examining market prices, valuations reveal what investors receive for those prices regarding earnings, cash flow, revenue, dividends, and other corporate metrics. While elevated valuations indicate investor optimism, they also suggest potentially excessive expectations in certain market segments.

The chart illustrates this concept using the Shiller price-to-earnings ratio for the S&P 500. The current reading of 38x significantly exceeds the 35-year average of 27x and nears levels witnessed during the dot-com era. This metric offers longer-term perspective compared to traditional P/E ratios by incorporating ten years of inflation-adjusted earnings data.

These valuation levels are unsurprising given the past two quarters' strong recovery. Since April 8, the S&P 500 has surged 34%, producing double-digit yearly gains. Technology stocks spanning multiple sectors have driven market advances, mirroring their leadership during declines. The Magnificent 7 stocks, for example, have jumped 61% from their lows. Despite growing investor skepticism regarding artificial intelligence spending returns, this factor has undeniably propelled broader market performance and business capital expenditures.

Importantly, valuations don't forecast near-term market direction and shouldn't be used for market timing. Rather, they function as fundamental inputs for asset allocation decisions. While broad market valuations appear stretched, this doesn't apply uniformly. Small-caps, value stocks, and international equities currently offer more appealing valuations compared to large-caps, growth stocks, and U.S. equities. This creates potential opportunities for investors maintaining broader perspectives and extended time horizons.

Federal Reserve reduces rates as employment market softens

In September 2025, the Federal Reserve lowered interest rates by 0.25%, continuing its easing cycle after maintaining steady rates for much of the year. This action reflects the Fed's effort to manage persistent inflation exceeding the 2% objective while addressing labor market deterioration. Markets widely anticipated this reduction, which has supported asset prices recently.

Several factors distinguish this easing cycle. Traditionally, the Fed has reduced rates responding to economic crises or recessions. While some weakness exists currently, overall growth remains solid. Therefore, recent cuts represent something distinct: policy normalization following the aggressive tightening that commenced in 2022. This explains why the Fed is easing despite ongoing economic expansion and markets reaching record levels.

Labor market deterioration has perhaps most significantly influenced the Fed's decision. Although the 4.3% unemployment rate remains historically low, job creation momentum has sharply decelerated. August recorded only 22,000 new payroll additions, substantially below the 123,000 average from earlier this year.

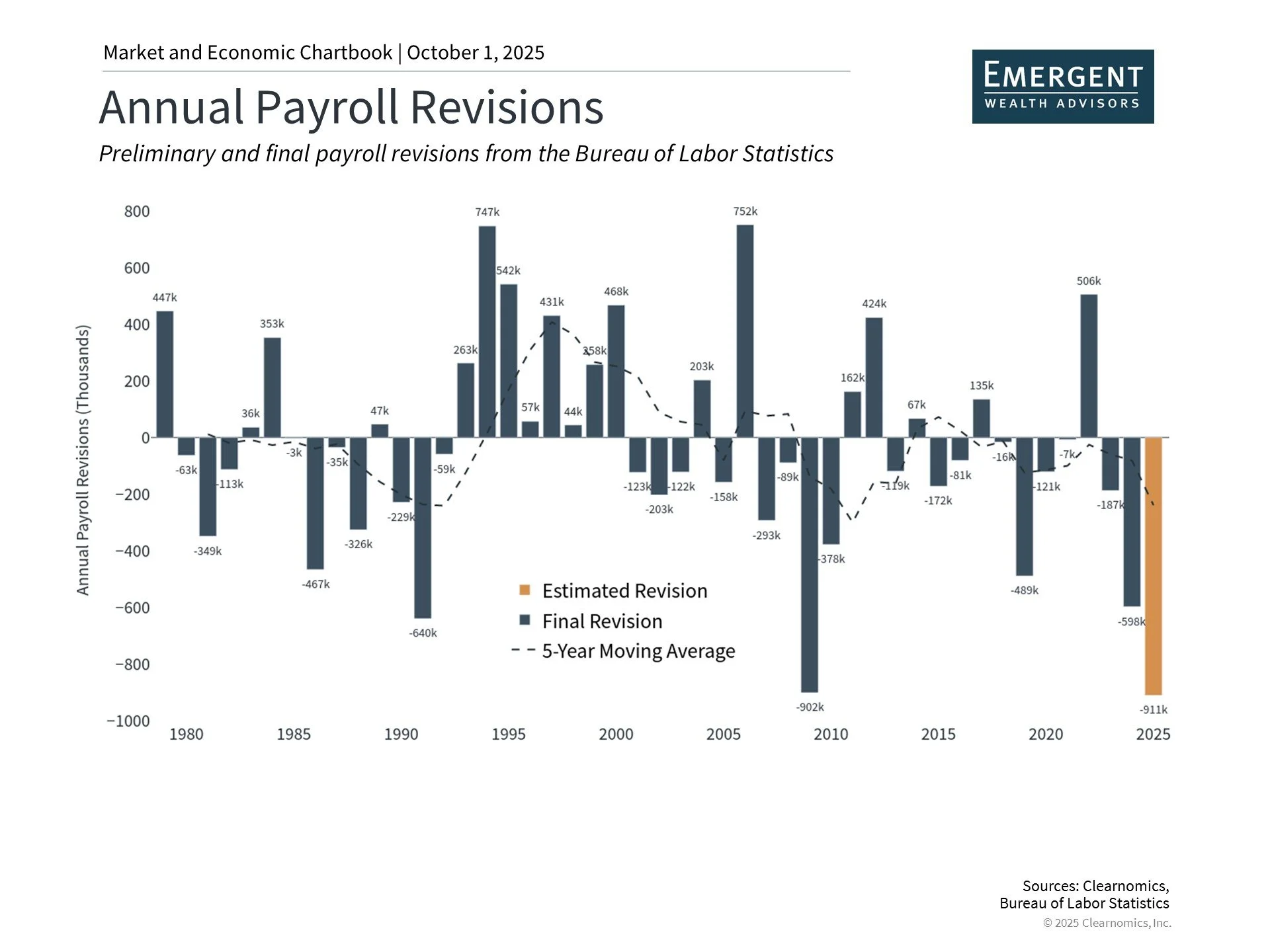

More notably, payroll revisions indicate 911,000 fewer jobs were generated during the twelve months ending in March than initially reported, as the chart demonstrates. Each year, the Bureau of Labor Statistics revises payroll figures using more comprehensive data than available during monthly releases. While these numbers remain preliminary, such a revision would constitute the largest historically, revealing weaker employment conditions than previously understood.

Consequently, the Fed is reducing rates because, per the latest FOMC statement, it "judges that downside risks to employment have risen." For investors, rate reductions typically benefit both equities and fixed income when economic conditions remain healthy.

Market turbulence and policy ambiguity have temporarily subsided

Following substantial volatility from earlier tariff and tax concerns this year, economic policy uncertainty metrics have improved. The VIX index measuring stock market volatility hovers near 16.3, beneath the long-term average of 18, while the MOVE index tracking bond market volatility has declined to 78, below its 87 average.

As experienced long-term investors understand, calm market periods can shift rapidly. Recent years have witnessed numerous volatility episodes stemming from inflation, trade disputes, Washington policies, Federal Reserve actions, recession concerns, geopolitical tensions, and additional factors. The current government shutdown represents merely the latest event potentially disrupting markets short-term, even if long-term impacts prove limited. Likewise, tariff policy outcomes and inflationary consequences remain unclear.

For investors, this uncertainty may generate discomfort, yet it also drives long-term portfolio results. Recent years also demonstrate the gap between investor fears and actual market performance. Rather than treating uncertainty as avoidable, successful long-term investors recognize it as a market characteristic creating opportunities to position portfolios for future years.

The bottom line? As the year's final quarter commences, markets trade near record highs while facing contradictory economic signals. This landscape emphasizes maintaining proper asset allocation and remaining focused on financial objectives.