Ensuring adequate savings for a lengthy retirement remains the paramount concern for retirees and those nearing retirement. Inflation over recent years has significantly diminished the buying power of cash reserves, making this challenge even more acute. Essential expenses for retirees—including healthcare, housing, and daily necessities—continue to reflect elevated price levels.

While equities and fixed-income securities offer strong solutions to address these concerns, some retirees maintain conservative investment preferences, and others question whether their savings will adequately counter rising living costs. For investors with long-term horizons, comprehending inflation's impact on retirement income and structuring portfolios to preserve purchasing power continues to be critically important. What key considerations should current and future retirees understand about managing their finances in the present landscape?

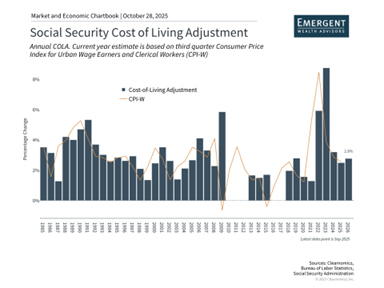

The disconnect between Social Security increases and actual cost pressures

The Social Security Administration's recent announcement of a 2.8% cost-of-living adjustment (COLA) for 2026 acknowledges ongoing inflation pressures. While beneficial, the price movements captured by official statistics often diverge from individual experiences with daily expenses. This adjustment translates to an average monthly benefit of $2,064, representing just a $56 increase. This stands in stark contrast to the 8.7% adjustment implemented in 2023, which marked the highest level since 1981.

A fundamental issue for those in retirement is that even when price growth decelerates, actual price levels seldom retreat. The COLA calculation relies on the CPI-W, a Consumer Price Index variant that monitors prices for working-class households. This methodology overlooks the reality that retirees typically encounter different inflation patterns compared to younger employed individuals. Categories such as healthcare expenses, housing costs, and other items that dominate retiree spending have frequently escalated more rapidly than broader inflation metrics indicate.

Consider that medical care services prices advanced 3.9% annually, health insurance costs jumped 4.2%, and home insurance expenses surged 7.5%. Food prices overall increased 3.1% during this timeframe, though meat, poultry and fish specifically rose 6.0%. Full service restaurant costs also climbed 4.2%.

Compounding these difficulties, Medicare Part B premiums are projected to increase $21.50 monthly in 2026, rising from $185 to $206.50 based on recent Medicare trustees' projections. Given that these premiums are generally deducted automatically from Social Security payments, this would consume roughly 38% of the typical $56 COLA increase, further constraining retirees' actual purchasing power.

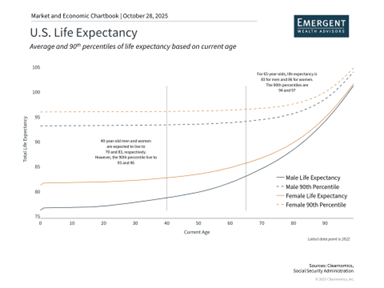

Extended lifespans elevate the need for portfolio appreciation

Similar to how investment returns can accumulate over extended periods, purchasing power erosion also compounds when portfolios fail to outpace inflation. This consideration carries greater weight currently as retirees must account for potentially living considerably longer than earlier generations. Consequently, longevity projections represent crucial variables in comprehensive financial planning.

Based on current Social Security Administration statistics, 40-year-old males and females demonstrate average life expectancies of 79 and 83 years, respectively. For individuals reaching age 65, these expectations extend to 83 and 86 years. These figures represent averages—those in the 90th percentile might live to 94 and 97, respectively.

Although the prospect of extended, healthier retirement years represents tremendous progress over the previous century, the distinction between a 20-year retirement horizon and one lasting 30 years or beyond carries profound implications for investment allocation and distribution strategies. This phenomenon, termed "longevity risk," presents an asymmetric challenge because depleting resources during retirement creates far greater difficulties than bequeathing assets to heirs or philanthropic organizations.

Therefore, while income-producing investments such as bonds receive considerable attention in retirement planning, maintaining growth-focused holdings like equities remains equally vital. This reality also introduces financial complexities that underscore the value of sophisticated planning. Constructing portfolios for multi-decade retirement horizons while managing distribution rates and responding to evolving market dynamics demands knowledge that extends well beyond conventional guidelines.

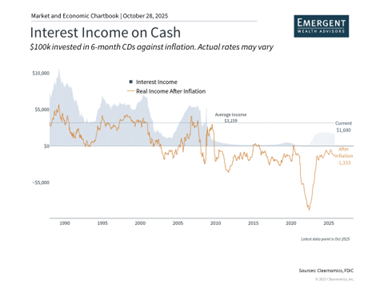

Declining policy rates diminish returns on cash holdings

Recent Consumer Price Index releases, which experienced delays stemming from the government shutdown, carry implications for Federal Reserve monetary policy and broader interest rate trends. Given moderating inflation alongside labor market softening, the Fed appears likely to proceed with gradual policy rate reductions. This transition, though beneficial for numerous economic sectors, will probably diminish interest income available through cash accounts and money market instruments over time.

For retirees who have relied upon interest earnings from cash positions throughout recent years, this shift toward a reduced interest rate environment may pose difficulties. While maintaining cash reserves for immediate expenses and contingencies remains prudent, excessive cash concentration means forgoing the appreciation potential of equities and the compelling yields still accessible across various fixed-income categories.

The convergence of persistent yet moderating inflation with declining interest rates establishes a demanding landscape for conservative investors. Cash holdings lose purchasing power to inflation while generating progressively lower interest as the Fed implements additional rate cuts. This dynamic reinforces the importance for retirees to maintain diversified portfolios incorporating growth-oriented holdings like equities, which have historically exceeded inflation across extended timeframes, alongside bonds offering income generation and portfolio stability.

The bottom line? Although Social Security COLA adjustments offer partial inflation protection, retirees face difficulties depending solely on these increases. Given rising life expectancies and falling short-term rates, investors require portfolios capable of delivering both income generation and capital appreciation.