January marked a positive beginning for both equity and fixed income markets, extending the rally that characterized recent years. This performance may come as unexpected given multiple episodes of market turbulence stemming from geopolitical developments and monetary policy considerations. Though headlines triggered near-term fluctuations, including the S&P 500's sharpest decline since the previous October, indices quickly regained momentum. Within a brief period, benchmark measures achieved fresh record highs, supported by robust corporate profitability that has bolstered investment portfolios.

For those focused on long-term wealth building, January offers an important lesson: news flow can trigger unpredictable market movements, yet underlying fundamentals and comprehensive financial planning remain paramount. Although geopolitical developments and policy ambiguity will probably generate additional turbulence during 2026, the most effective approach for managing these obstacles continues to be a diversified portfolio that corresponds with your extended financial objectives.

Primary Market and Economic Factors in January

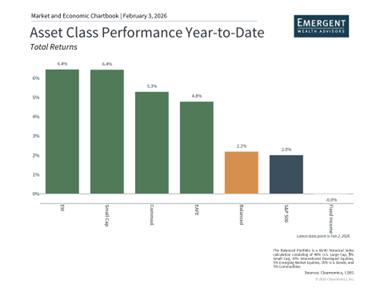

• The S&P 500 advanced 1.4% during January and temporarily exceeded 7,000 on an intraday basis for the first time. The Nasdaq Composite increased 0.9% while the Dow Jones Industrial Average rose 1.7%.

• The CBOE VIX volatility index concluded the month at 17.44 following an increase above 20 triggered by geopolitical concerns.

• The Bloomberg U.S. Aggregate Bond Index edged up 0.1% throughout the month as longer-dated interest rates climbed. The 10-year Treasury yield finished the month at 4.24%, representing the highest reading since the prior September.

• International developed markets surged 5.2% in U.S. dollar terms according to the MSCI EAFE Index, while emerging markets advanced 8.8% based on the MSCI EM Index.

• President Trump revealed the nomination of Kevin Warsh as the forthcoming Fed Chair. Upon Senate confirmation, he would assume the position in mid-May.

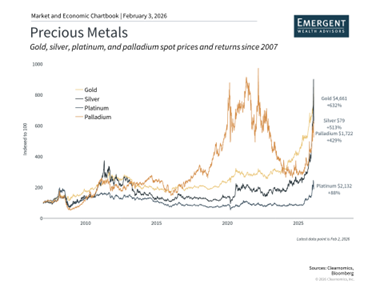

• Gold climbed to a record closing price of $5,417 per ounce before dropping nearly 10% on January 30.

• Likewise, silver reached a closing high of $116.70 before declining to conclude the month at $85.20.

• The U.S. dollar index declined further to approximately 97.0, touching its lowest point in almost four years, before recovering modestly after the Fed Chair announcement.

• The Federal Reserve maintained its policy rate at 3.50 to 3.75% during its January meeting, after three straight quarter-point reductions in the latter half of 2025.

• Consumer Price Index inflation held steady at 2.7% year-over-year in December, remaining above the Fed's 2% objective. The Producer Price Index increased to 3.0%.

• Washington concluded the month facing a partial government shutdown.

• Harsh winter conditions throughout significant portions of the Eastern and Southern United States led natural gas and electricity prices to jump.

Geopolitical developments pushed market volatility upward

During the month's opening days, a U.S. military action in Venezuela led to the apprehension of Nicolás Maduro. Though the mission focused on narco-terrorism, discourse rapidly pivoted to petroleum. Venezuela possesses the world's most substantial proven oil reserves yet produces less than 1% of worldwide crude output owing to its inadequate infrastructure. For market participants, the chief mechanism through which geopolitical developments influence financial markets operates through commodity valuations, with oil maintaining its centrality to the worldwide economy.

Geopolitical anxieties intensified further following U.S. commentary about acquiring Greenland given its strategic significance for defense and natural resources. This ignited diplomatic tensions with NATO partners involving trade measures that produced the S&P 500's most severe decline since the previous October. Nevertheless, circumstances rapidly deescalated following President Trump's meeting with the NATO secretary general and establishment of a "framework of a future deal," prompting the market to recover.

For investors with extended time horizons, geopolitical developments may generate near-term uncertainty, but historical evidence demonstrates that their impacts on markets and the economy are frequently exaggerated. Markets have generally bounced back as the initial disruption subsides. Investors should refrain from excessive reactions to headlines and instead preserve a long-term emphasis on financial objectives.

Federal Reserve uncertainty influenced precious metals and currency markets

Precious metals sustained their rally until a substantial reversal on January's closing day. Gold climbed to nearly $5,600 on an intraday basis while silver's spot price surpassed $120 per ounce before both experienced sharp selloffs. These movements have been propelled by multiple factors including geopolitical risk, central bank acquisitions, and apprehensions regarding Federal Reserve independence.

The dynamics propelling gold and silver have been characterized as the "debasement trade," representing the concept that fiscal and monetary policies that essentially diminish the dollar, generate deficits, and result in inflation may bolster precious metals. Fed uncertainty, encompassing whether a new Fed chair might pursue lower interest rates, has elevated these metals.

Nevertheless, on January 30, President Trump revealed his intent to nominate Kevin Warsh as the subsequent Fed Chair following Jerome Powell's term expiration in mid-May. Warsh served as a former Fed governor who has recently indicated his preference for reduced interest rates. Though he has also demonstrated hawkish tendencies historically, signifying he has supported maintaining elevated rates to combat inflation. For market participants, this altered expectations since it implies a potentially smoother leadership transition between Fed Chairs. This triggered a sharp decline in both gold and silver, accompanied by a modest dollar appreciation.

This reversal highlights both that precious metals experience boom-and-bust patterns, and illustrates how rapidly markets can pivot based on policy anticipations. While precious metals can benefit investors, their turbulence throughout January illustrates why they must complement, rather than substitute, foundational positions in equities and fixed income.

Corporate profitability maintained strength amid uncertainty

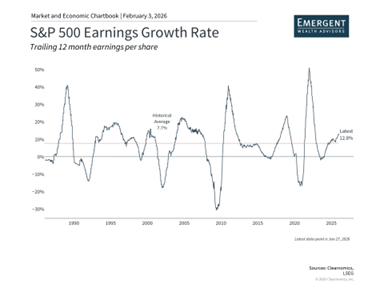

Apart from the principal global headlines, fourth quarter financial results revealed that corporations continue demonstrating solid performance. Per FactSet, 33% of S&P 500 constituents have disclosed results and 75% have surpassed expectations. Should these patterns persist, large publicly traded companies could achieve a growth rate of 11.9% for the quarter, marking the 5th straight quarter of double-digit earnings expansion. On a trailing 12-month basis, earnings growth has accelerated to 12.8% according to consensus projections.

Understandably, numerous investors concentrate on AI and technology earnings given these equities have driven market returns throughout recent years. Thus far, markets have exhibited mixed responses to these companies' earnings, even when they exceed estimates, attributable to elevated expectations and questions surrounding the sustainability of this expenditure. Concurrently, numerous other sectors have gained from broad economic expansion and have expanded their earnings at an accelerated pace as well.

For investors with long-term perspectives, the core message from earnings season proves encouraging. Corporate profitability maintains strength across numerous sectors, validating equity valuations. This fundamental resilience explains why major indices sustained positive performance for the month notwithstanding substantial volatility.

Harsh winter conditions impacted substantial portions of the nation

January's severe winter weather, designated Winter Storm Fern, impacted no fewer than 21 states and more than half the U.S. population. The storm necessitated state emergency declarations and generated disruptions to economic activity, including power failures and thousands of flight cancellations.

While the welfare of those impacted by the storm represents the paramount concern, historical evidence demonstrates that weather-related disruptions including hurricanes and blizzards exert minimal lasting impact on the national economy. The critical distinction involves whether these events damage productive capacity including factories, equipment, and enterprises, or whether they merely delay activity. In this instance, temporary disruptions to sectors including retail and construction simply defer economic activity.

The bottom line? January witnessed market turbulence stemming from geopolitical developments, Federal Reserve uncertainty, and additional factors. Nevertheless, markets demonstrated resilience and strong corporate profitability helped benchmark indices achieve fresh record highs, even as precious metals faltered. For investors focused on long-term objectives, this reinforces the significance of sustaining appropriate asset allocation that aligns with financial goals.