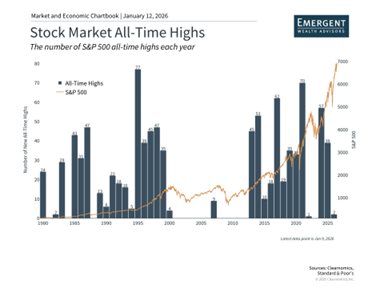

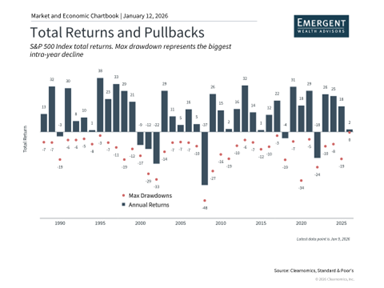

Markets delivered exceptional results in 2025, navigating through numerous meaningful events throughout the year. Despite headlines ranging from tariff policy shifts in April to advances in artificial intelligence technology and the enactment of the One Big Beautiful Bill Act, investors enjoyed impressive gains. U.S. equities reached fresh all-time highs, international markets delivered superior performance, and fixed income securities extended their recovery. The S&P 500 has now posted gains exceeding 10% in six out of the last seven years, with its value nearly doubling from the 2022 market trough.

Last year's experience reinforces a fundamental principle: maintaining discipline and concentrating on long-term objectives represents the most effective approach to managing uncertainty. Looking forward to 2026, examining the factors that propelled markets in 2025 can provide valuable insights for investors as they face future challenges and capitalize on emerging opportunities.

Primary Market and Economic Factors in 2025

• Including dividends, the S&P 500 advanced 17.9% during 2025, recording 39 new record closes. The Dow Jones Industrial Average climbed 14.9% while the Nasdaq delivered a 21.2% return.

• The VIX, which tracks stock market volatility expectations, concluded the year at 14.95—below historical averages—despite reaching 52.33 in April.

• The Bloomberg U.S. Aggregate Bond Index rose 7.3%, marking its strongest year since 2020. The 10-year Treasury yield declined to 4.17% by year-end from 4.57% at the beginning of 2025.

• International developed markets and emerging markets both surged more than 30% in U.S. dollar terms according to the MSCI EAFE Index and MSCI EM Index.

• The U.S. dollar index fell 9.3% to 98.32 from 108.49 at year-start, touching a yearly low of 96.63 in September.

• Bitcoin decreased approximately 6.5% from $93,714 to $87,647, following a peak of $125,260 in October.

• Gold prices surged throughout 2025, ending at $4,341 per ounce for a 64% increase. Silver prices similarly advanced to $70.60 per ounce from $29.24 at the start of the year.

Significant events throughout 2025

Much of what transpired during 2025 fell into the category of "known unknowns." Former Secretary of Defense Donald Rumsfeld popularized this framework, separating "known unknowns" from "unknown unknowns." For market participants, this distinction proves valuable since the former represents uncertainties that can be anticipated. When markets respond to such events, investors who prepare accordingly can avoid unwelcome surprises.

Tariff-related concerns, for example, were prominently featured on investors' radar screens prior to April 2. While the magnitude of these tariffs still generated market volatility, advance awareness enabled markets to recover swiftly as developments unfolded. Similarly, investors anticipated Federal Reserve rate adjustments in response to weakening employment conditions. The passage of new tax legislation was also widely expected given Republican control of both congressional chambers.

Even questions surrounding artificial intelligence, perhaps the most significant source of market uncertainty today, have remained central to investor thinking. The DeepSeek development in January—when a Chinese AI firm demonstrated that advanced models could be developed and operated at lower costs—came as a surprise. However, the similarities to the dot-com era and previous cycles of elevated capital spending by major corporations are widely recognized.

The following represents a summary of the ten most significant market-moving developments throughout the year:

• January 20: President Trump is inaugurated.

• January 21: The $500 billion private-sector Stargate project is announced.

• January 27: AI stocks fall on DeepSeek news.

• April 2 to 9: "Liberation Day" tariff announcement leads to a market correction. This was followed by a 90-day pause which sparked a rally.

• July 4: The "One Big Beautiful Bill Act" is signed into law, extending many Tax Cuts and Jobs Act provisions.

• September 17: The Fed begins cutting interest rates again.

• September 22: Nvidia and OpenAI announced a major strategic partnership and investment, raising concerns of "circular deals."

• October 1: The government shuts down for what would be a record-setting 43 days.

• October 14: Jamie Dimon warns of "cockroaches" after the bankruptcies of Tricolor and First Brands.

• December 16: According to the BEA, the unemployment rate hit a four-year high of 4.6% in November.

Three primary themes characterized 2025

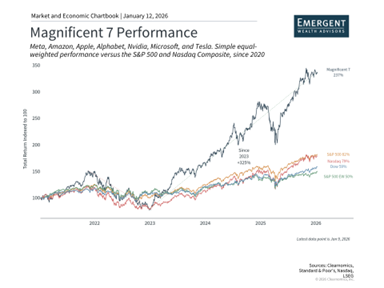

Which themes influenced markets throughout these events? First, artificial intelligence clearly dominated market discussion throughout 2025. From substantial infrastructure commitments to questions about market concentration, AI emerged as a crucial driver of economic expansion and market performance. The Magnificent 7 stocks currently comprise approximately one-third of the S&P 500, introducing concentration risk that affects most investors regardless of whether they acknowledge this exposure. Understanding this dynamic when developing investment strategies and financial plans will become increasingly critical.

Second, tariff policy generated uncertainty but produced smaller economic effects than anticipated. While tariffs on imports increased substantially for numerous trading partners, the predicted economic disruptions mostly did not occur. Companies adjusted their operations, tariffs were delayed or reduced, and consumer expenditures stayed robust. For investors, this demonstrates that policy shifts in Washington—whether involving trade or government finances—do not always produce clear impacts on the economy or financial markets.

Third, numerous asset classes delivered strong performance during 2025. International equities outperformed domestic markets, partly reflecting U.S. dollar weakness. Fixed income securities produced solid returns and have substantially recovered from their 2022 declines. Other individual assets such as gold also achieved record performance. Therefore, capturing returns across these asset classes depends less on selecting individual investments and more on establishing appropriate asset allocation that can exploit opportunities while controlling risk exposures.

The bottom line? Investors experienced a strong year in 2025. While positive market performance is certainly welcome, it emphasizes the critical importance of sustaining investment discipline. Investors should carry this principle forward as they develop their investment and financial strategies for the year ahead.