November brought a wave of volatility across multiple asset classes, driven by concerns about artificial intelligence investments and uncertainty surrounding Federal Reserve policy decisions. Although major indices have posted impressive year-to-date gains across equities, fixed income, and international markets, the government shutdown complicated matters by delaying critical economic data releases.

By month's end, many asset classes had stabilized and recovered from earlier declines. This pattern reinforces a fundamental principle for long-term investors: maintaining a well-balanced portfolio designed to weather market fluctuations. Success in investing comes from staying committed to long-term objectives rather than responding to short-term movements or news cycles.

November Market Performance Highlights

The S&P 500 edged up 0.1% while the Dow Jones Industrial Average added 0.3%, and the Nasdaq fell 1.5%. For the year, the S&P 500 has climbed 16.4%, the Dow 12.2%, and the Nasdaq 21.0%.

The VIX concluded November at 16.35 after spiking to 26.42 during the month.

The Bloomberg U.S. Aggregate Bond Index advanced 0.6% for the month and 7.5% year-to-date. The 10-year Treasury yield closed at 4.02%.

International developed markets rose 0.5% in U.S. dollar terms via the MSCI EAFE Index, while emerging markets declined 2.5% per the MSCI EM Index. Year-to-date gains stand at 24.3% and 27.1% respectively.

Bitcoin dropped approximately 17% during November, finishing at $91,176.

Gold ended higher at $4,218, though below October's record of $4,336.

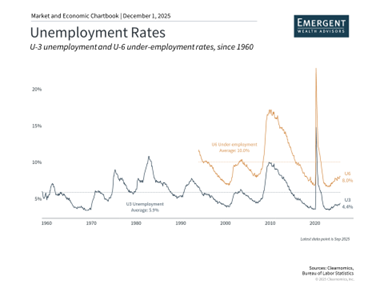

The delayed September jobs report revealed 119,000 new positions and an unemployment rate of 4.4%. No October report will be released.

Risk assets faced temporary pressure

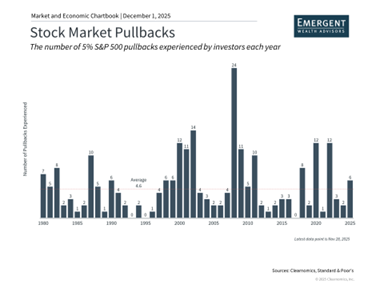

Investors temporarily rotated out of risk assets including technology equities, high-yield bonds, and cryptocurrencies. Questions about AI investment sustainability and shifting Federal Reserve expectations drove this movement. The S&P 500 experienced its sixth decline of 5% or more this year, matching typical historical patterns, though many assets recovered before month's end.

Technology stocks linked to AI saw their most challenging week since April. Despite concerns about spending levels and profit margins, underlying fundamentals remained solid, with companies like Nvidia posting strong third-quarter results. Several Magnificent 7 stocks rebounded following earnings announcements.

The bond market gained ground as long-term rates declined, with the 10-year Treasury yield dipping below 4%. The Bloomberg U.S. Aggregate Bond Index has delivered its strongest yearly performance since 2020, providing valuable diversification benefits.

Economic data gaps persist despite shutdown resolution

After 43 days, the government shutdown concluded, though federal funding only extends through January 2026. Markets largely navigated through this period despite limited economic data availability. The September jobs report showed stronger-than-expected job creation, though revised August figures revealed 4,000 job losses. The unemployment rate reached 4.4% in September, its highest since October 2021, while remaining historically low.

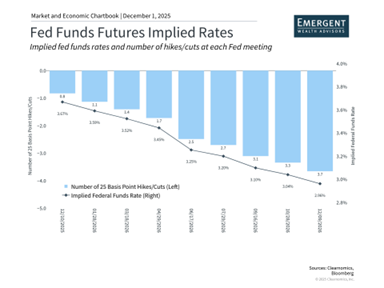

Federal Reserve rate cut expectations have fluctuated

Data delays mean the Federal Reserve faces its December meeting with incomplete economic information. Market expectations for rate cuts have shifted considerably, currently suggesting cuts in December and again in spring 2026. Consumer confidence has weakened, with the University of Michigan's Index falling from 53.6 to 50.3 in November, though poor sentiment has not significantly impacted spending patterns.

The bottom line? November's market swings and economic uncertainty highlight that volatility is a normal part of investing. As the year concludes, maintaining perspective and a disciplined approach remains essential for long-term success.